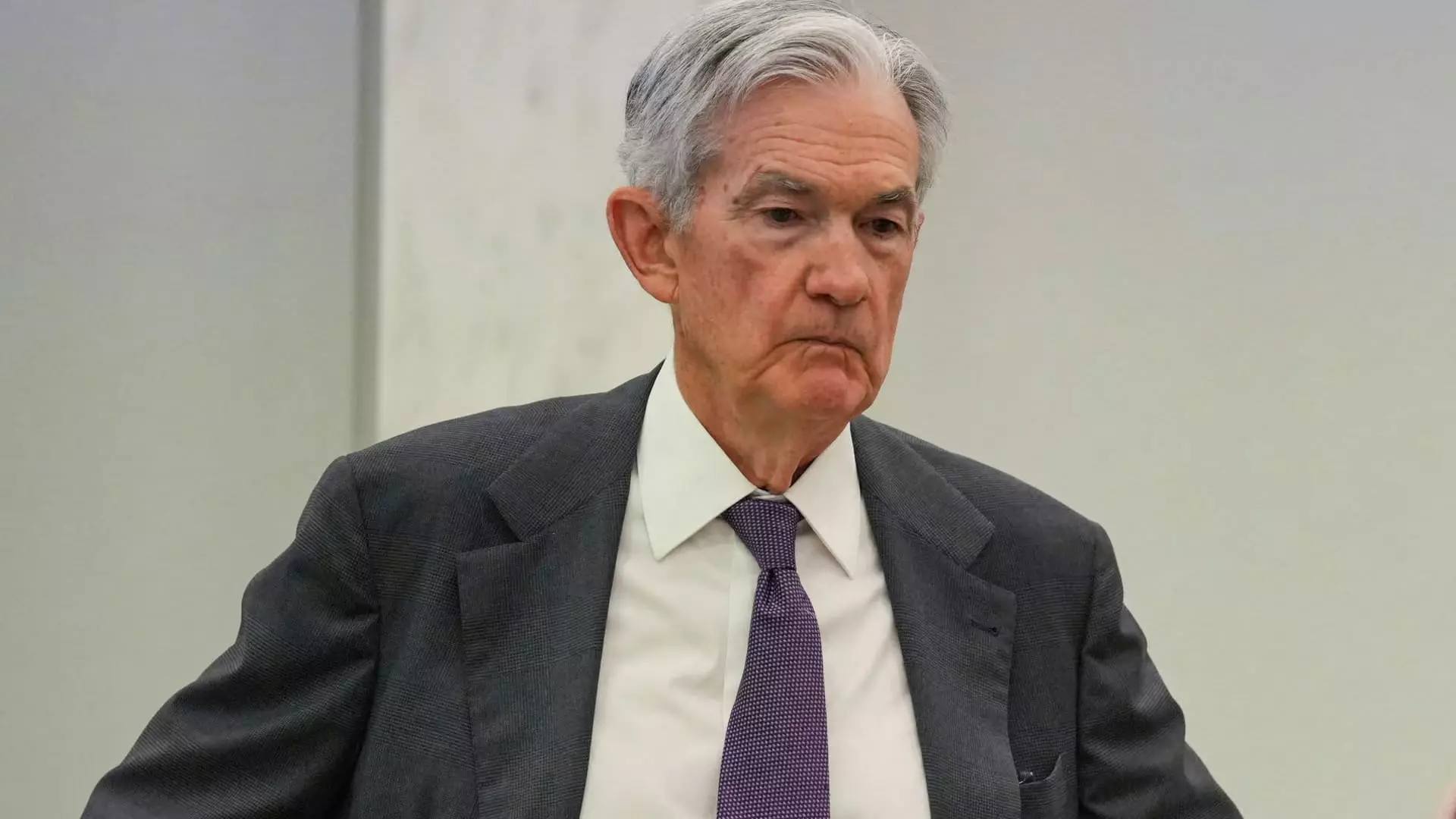

In recent remarks, Treasury Secretary Scott Bessent elegantly sidestepped calls for Jerome Powell’s resignation, instead advocating for a comprehensive internal review of Federal Reserve operations. While this nuanced stance might appear moderate, it reveals a fundamental misunderstanding—or perhaps a deliberate downplaying—of the central bank’s true nature. The Fed’s autonomy is often heralded as a pillar of economic stability, yet beneath this veneer lies a fragile institution vulnerable to political pressures—a vulnerability that Bessent’s call for review inadvertently exposes. When monetary policy decisions become entangled with political agendas, the legitimacy of the entire system erodes. Bessent’s emphasis on conducting an internal review “off to the side” dismisses the reality that transparency and accountability should be ingrained, not afterthoughts. Political influence, especially from an administration like Trump’s, openly clamoring for interest rate cuts and scrutinizing expenditures, underscores the deeper crisis of independence that the Fed desperately needs but continuously struggles to assert.

The Power Struggle: Market Confidence vs. Political Pressure

The ongoing tug-of-war between President Trump’s aggressive push for lower rates and the Fed’s cautious approach highlights a fundamental challenge: the politicization of monetary policy. Trump’s publicly stated hopes for Powell’s resignation amid calls for a drastic rate cut are not just personal grievances—they threaten to undermine investor confidence in the Federal Reserve’s ability to act as a non-partisan guardian of economic stability. If the market perceives that interest rate decisions are driven by political whims rather than objective economic data, chaos ensues. The Fed’s insistence on waiting to see the effects of tariffs and trade tensions before adjusting rates exemplifies its need to maintain a semblance of independence. Yet, the constant barrage of presidential critique fuels uncertainty, risking the integrity of monetary decision-making. The danger is palpable: when the central bank becomes a pawn in political games, the credibility of its policy is compromised, and economic stability becomes collateral damage.

The Futility of Superficial Oversight in a Politicized Environment

Bessent’s proposal for an internal review, removed from the glare of political influence, may seem prudent on paper. However, in a climate where political actors are actively attempting to influence monetary policy, such a review risks being a mere façade—window dressing rather than a meaningful reform. Historically, the Fed’s core challenge has been maintaining independence amid external pressures, and superficial oversight serves only to deepen public skepticism. The notion that the Fed has “just grown” without proper oversight is a contradiction—growth in scope, influence, and complexity almost demands more transparent mechanisms, not less. If Powell’s legacy is to be truly meaningful, he must confront these pressures head-on, advocating for structural reforms that insulate the central bank from political meddling. Otherwise, the Fed risks becoming just another tool of partisan interests, eroding trust and destabilizing markets in the process.

The Illusion of Market Expectations and the Reality of Political Discontent

Despite widespread market consensus favoring a hold on interest rates, the political landscape remains volatile. Expectations for a possible rate cut in September are based on economic indicators, not political influence—yet, the political storm threatens to overshadow these cues. The Fed’s current stance suggests a cautious approach, keen on avoiding knee-jerk reactions driven by political noise. Still, the mounting pressure from leadership figures like Trump undermines this neutrality. If the Fed caves to such influences, it risks a dangerous precedent: politicizing the core of macroeconomic management. Markets might project confidence in central bank decisions, but behind the scenes, the brewing discontent risks fraying the delicate balance of economic governance, paving the way for unpredictable outcomes and volatile markets.

A Call for a Refreshingly Honest Debate on Central Bank Power

What is desperately needed is an unapologetic, honest debate about the role of the Fed and its true independence. The current narrative—where the central bank is depicted as a sacrosanct institution immune to political whims—may serve as comforting rhetoric, but it doesn’t match reality. The recent pushback from political figures demonstrates a fundamental misunderstanding of the Fed’s purpose and vulnerabilities. Failing to confront these issues head-on only fosters complacency, while political meddling continues to gnaw at the foundations of economic stability. Responsible reform demands that policymakers prioritize genuine independence, accountability, and transparency—clearly delineating the limits of political influence over monetary policy. Without this, the façade of the Fed as an autonomous guardian of the economy will crack, exposing vulnerabilities that threaten to plunge markets into chaos at the slightest provocation.