The sudden surge of Luxshare’s shares by approximately 10% on a single day exemplifies how financial markets react to the buzz surrounding technological breakthroughs. While some might interpret this as a sign of forward-looking confidence, it’s crucial to scrutinize whether this movement is genuinely fueled by substantive innovation or merely speculative hype. Luxshare, a company

China’s recent assertiveness in developing its technology sector signals a clear shift in its strategic stance: moving away from reliance on Western hardware and software giants. The surge of Alibaba and Baidu stocks reflects not just market optimism but a broader national push toward technological independence. This momentum suggests that China no longer views foreign

In an era marked by unpredictable monetary policies and economic turbulence, dividend stocks have become the safe harbor for many investors. The recent Federal Reserve decision to cut interest rates signals a fundamental shift—one that many interpret as an official retreat from high-rate territories into more accommodative monetary waters. Yet, this “stability” is an illusion

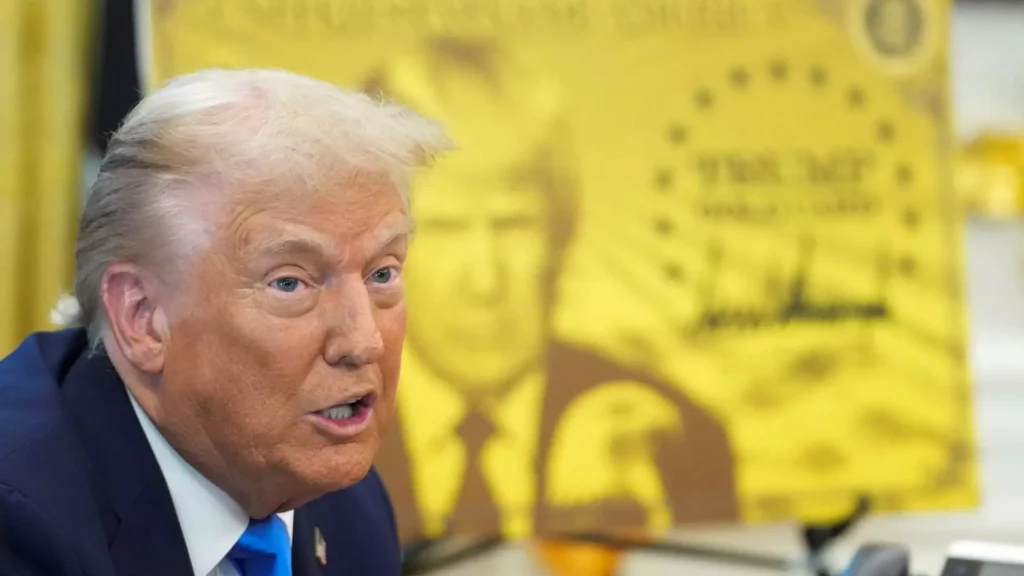

The announcement by President Trump to impose a $100,000 annual fee on H-1B visas represents a seismic shift in U.S. immigration policy—one that risks unsettling the very foundations of America’s technological prowess. While the intent might be framed as protecting American workers and prioritizing domestic employment, the reality reveals a perilous tug-of-war between nationalism and

Meta’s latest venture into wearable technology, the $799 Ray-Ban Display glasses, promises to reshape our digital landscape by positioning smart glasses as the new frontier of personal computing. However, beneath the glossy veneer of innovation lies a series of glaring shortcomings that threaten to undermine this ambitious vision. While Meta touts these glasses as a

Workday has long been heralded as a titan within the enterprise software landscape, especially for human capital and financial management solutions. Boasting a clientele of over 11,000 organizations, including a significant portion of Fortune 500 companies, the company’s platform is viewed as a reliable, sticky, and innovative product. Its reputation for high customer retention, clocked

Cinema has long been a mirror reflecting societal fears and fascinations. Recently, the documentary *Chain Reactions* has shed light on the enduring influence of Tobe Hooper’s 1974 horror masterpiece, *The Texas Chainsaw Massacre*. It’s not merely a film but a cultural phenomenon, capturing the primal fears of a society grappling with violence and chaos. The

In a world increasingly driven by digital assets, the story of Kevin Durant’s recent account recovery sheds a glaring spotlight on the vulnerabilities inherent in current cryptocurrency platforms. Durant, a renowned NBA star, had his Bitcoins locked away for years, a situation that symbolizes a broader issue: even high-profile investors are not immune to the

In recent months, the tech world has been gripped by an incredible surge in valuations for AI startups, and xAI is undeniably at the heart of this frenzy. With reports suggesting it’s raising $10 billion at a staggering $200 billion valuation, the narrative is one of exponential growth and limitless potential. However, beneath this glittering

In recent financial discussions, a notable Fed official has challenged the conventional wisdom regarding the inflationary impact of tariffs. Stephen Miran, a Federal Reserve Governor, openly dismisses concerns that President Trump’s trade measures are fueling inflationary pressures. His stance deserves scrutiny, not just as a contrarian viewpoint but as a reflection of a broader ideological