The Consumer Financial Protection Bureau (CFPB), an agency vital for safeguarding consumer rights in financial dealings, faces unprecedented turmoil. In a recent directive, employees were instructed to telecommute following the announcement that the Washington, D.C., headquarters would be closed until February 14. This decision is a significant reduction in the agency’s operational capacity and reflects a worrying trend amidst leadership changes. Acting CFPB Director Russell Vought’s initial communication ordered the suspension of nearly all regulatory activities, igniting fears among employees regarding the agency’s stability and future.

The uncertainty surrounding the CFPB has compounded with the involvement of personnel affiliated with Elon Musk’s DOGE initiative, who have reportedly been granted access to the agency’s data repositories. This move raises serious concerns over the confidentiality of the agency’s operations and the potential for conflicts of interest given Musk’s previously vocal opposition to the CFPB’s existence. Musk’s social media activity, including a recent provocative post declaring “CFPB RIP,” signals a potentially hostile agenda aimed at dismantling the agency’s critical functions.

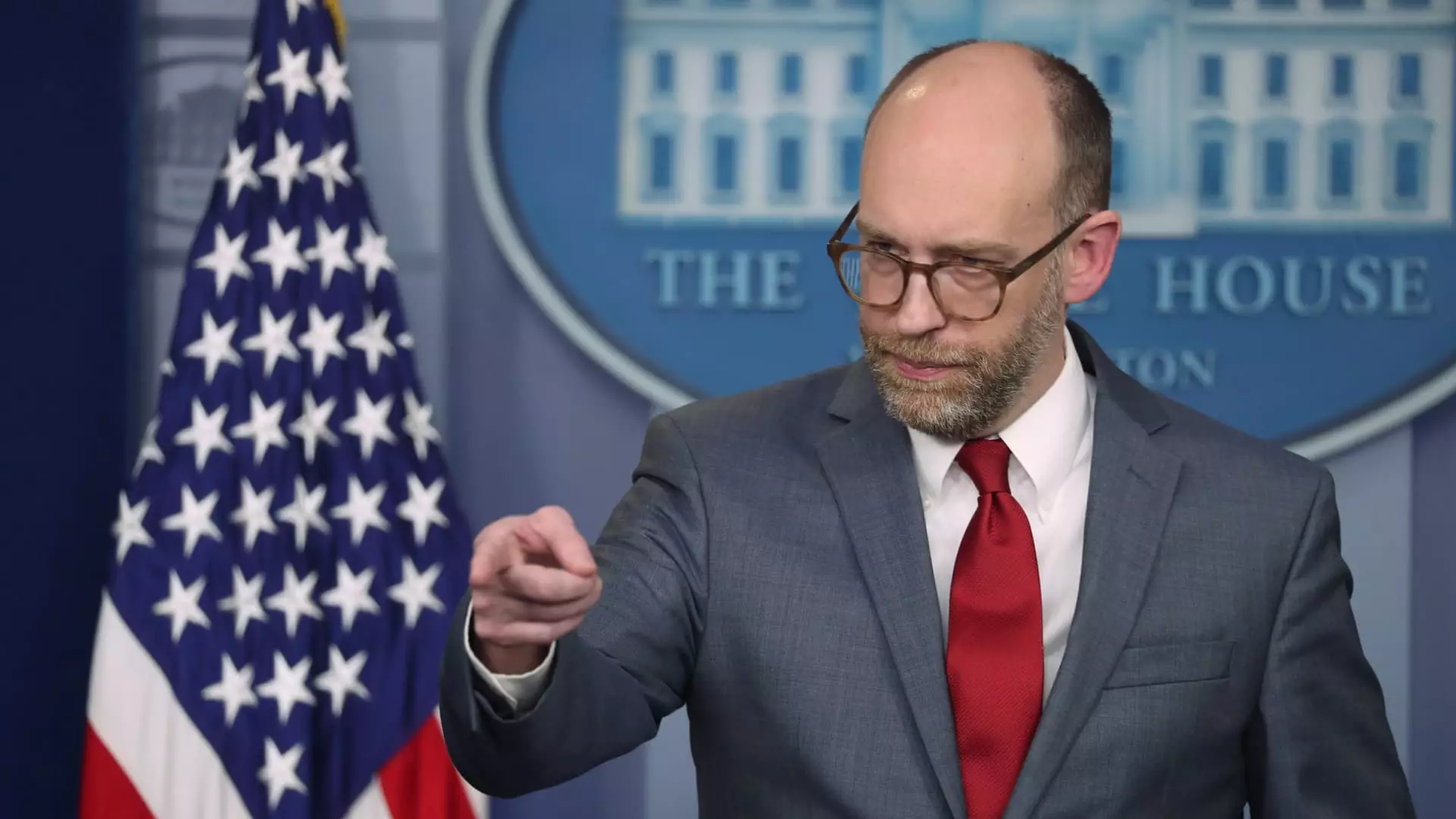

Vought’s questionable management approach seems rooted in a broader ideological framework. Recently confirmed as the director of the Office of Management and Budget, he is associated with Project 2025, a conservative initiative aimed at restructuring federal operations. Vought’s declaration to halt fresh funding to the CFPB is alarming; he characterizes past funding as a source of “unaccountability,” thereby questioning the agency’s legitimacy and highlighting a partisan struggle over regulatory oversight.

The ramifications for CFPB employees are dire. With approximately 1,700 staff members, many face potential administrative leave or layoffs, reminiscent of moves previously attempted against other federal agencies. The chilling effect of such turmoil extends beyond the workforce; it poses a substantial risk to consumer protections established in the wake of the 2008 financial crisis. Those protections are critical for preventing financial institutions from exploiting vulnerable citizens.

Banking lobbyists have consistently targeted the CFPB, challenging its authority and questioning its regulatory approach. Despite these pressures, the agency has been key in implementing measures designed to shield consumers from excessive charges, such as exorbitant credit card fees and harmful overdraft penalties. The enforcement of rules that would alleviate billions in medical debt for millions of Americans hangs in the balance as the very institution advocating for these protections appears to be on the brink of collapse.

The future of the CFPB remains uncertain as ideological battles persist over its existence and authority. Employees and advocacy groups are left to ponder the long-term implications of this turbulence, particularly in a regulatory environment where consumer rights can easily be sidelined. The actions of Vought and the influence of external parties like the DOGE operatives could drastically reshape the agency, dismantle its critical functions, and ultimately endanger the financial well-being of millions of Americans. The coming weeks will prove crucial in determining whether the CFPB can endure this turbulent chapter and fulfill its mission to protect consumers from financial malfeasance.