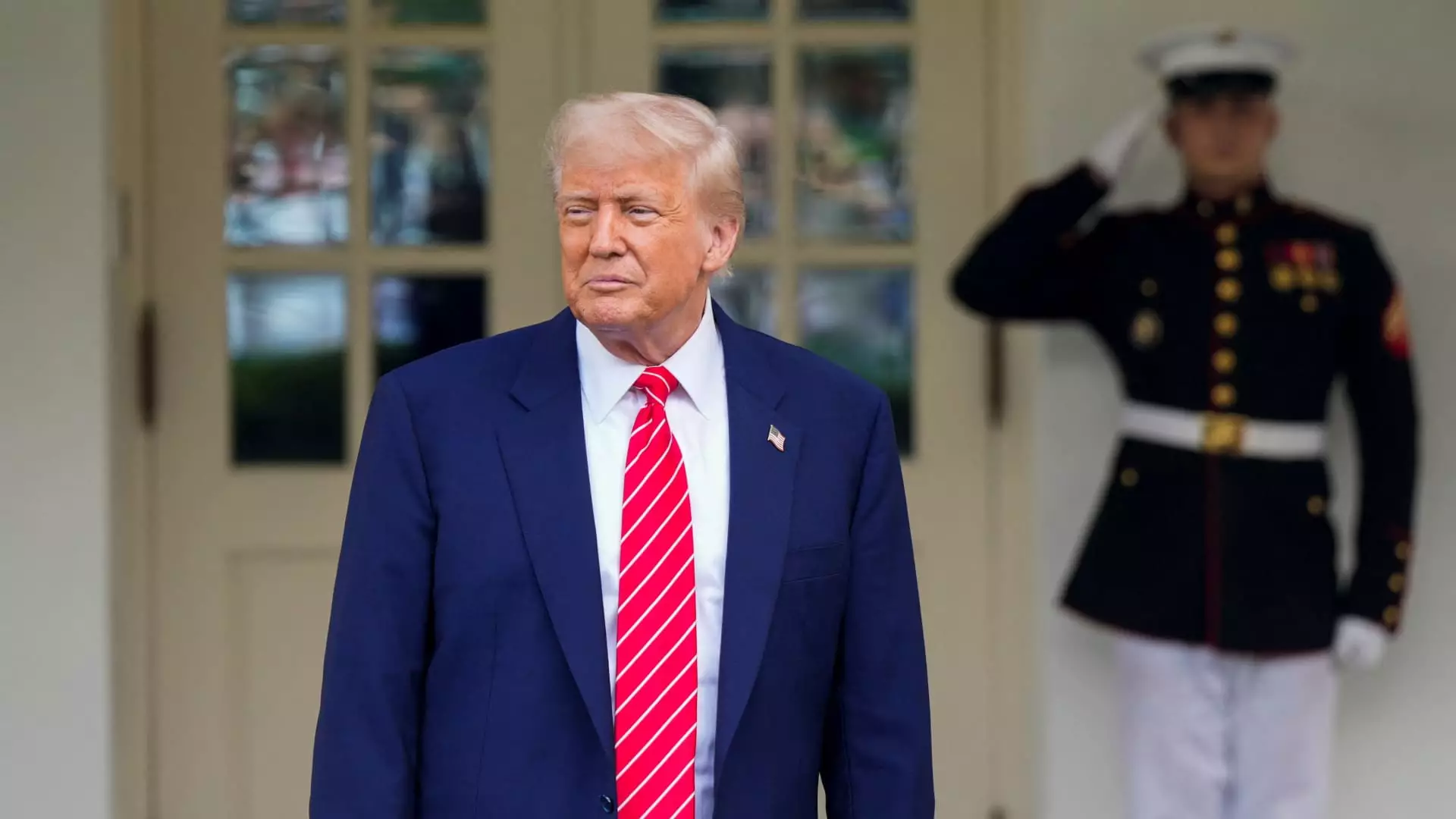

In a political climate where compromise is rare and the stakes are exceptionally high, the recent failure of the GENIUS Act to pass highlights a critical issue in American governance. With President Donald Trump at the helm, any hope for a bipartisan approach to cryptocurrency regulation was swiftly dashed, all due to his dubious personal financial entanglements. The legislative landscape has become increasingly fragile, particularly for Republicans who are wrestling with a narrow majority. They are trapped in a vortex where the president’s personal agenda conflicts fundamentally with the broader interests of the nation. Lawmakers are left caught between the desire to regulate a rapidly evolving crypto market and the glaring ethical concerns raised by Trump’s active investment in the very industry they aim to legislate.

Some might argue that the political maneuvering is merely a reflection of the partisan atmosphere, but Sen. Jeff Merkley’s statements convey a deeper truth: this is not just about politics; it is also fundamentally about integrity. When lawmakers like Merkley call the situation a “profoundly corrupt scheme,” he is not simply positioning himself against Trump but rather identifying a crisis of ethics that undermines public trust.

2. Compromised Legislation and Ethical Dilemmas

The implications of Trump’s cryptocurrency ventures extend far beyond mere optics; they feed into a poisonous system where personal gain is prioritized over important bipartisan efforts aimed at consumer protection and market stability. The GENIUS Act was designed to establish concrete federal regulations for stablecoins—digital currencies pegged to stable assets, such as the U.S. dollar. Yet, the fate of the bill was sealed by the overwhelming presence of Trump’s financial interests. With reports indicating that Trump’s tech outfit, World Liberty Financial, was involved in launching a stablecoin, the perception of impropriety becomes insurmountable.

It’s not just Trump’s direct links; the entire crypto community is further polarized as public officials must now sift through the murky waters of a conflict of interest. If lawmakers are constrained in both their ability and willingness to pass legislation due to ethical concerns, we are left with a regulatory vacuum, which has implications for investors, consumers, and the crypto market’s future. This isn’t just an embarrassment for Trump; it raises questions regarding the very essence of governance and accountability in the modern age.

3. The Battle for Public Trust

Public confidence in government is inherently fragile, and when you factor in a president who appears to use the tools of his office not for public service but for personal gain, the ramifications are severe. Critics, including heavyweights like Senator Elizabeth Warren and Kirsten Gillibrand, are correct to draw focus to Trump’s conflicts. When public figures and elected officials profit from the policies they create, it leads to a pervasive skepticism that undermines the fabric of democracy.

Moreover, the perception that legislation is being influenced by personal financial gain poses a significant threat to the integrity of institutions. For crypto technology and its advocates, the notion that the president may personally profit from legislation designed to govern the industry is an impediment not only to fair regulation but also to investment and innovation. The fallout from this could lead to the U.S. being seen on the global stage as the poster child for ineffective governance in the cryptocurrency space.

4. Impediments to Technological Advancement

The toxic combination of Trump’s personal interests and legislative gridlock could place the United States at a competitive disadvantage in terms of technological advancement. As both the GOP and Democrats have had to wrestle with Trump’s actions, it’s become apparent that innovation in the crypto industry is being stymied. The crypto community was already reeling from setbacks during the Biden administration, but now, Trump’s involvement adds a layer of complexity that could discourage investment.

The crypto lobby has emerged as a powerful force, but with the president perceived as entangled in a self-serving agenda, the concerns are amplified. Investors and entrepreneurs alike express frustration, arguing that Trump’s pursuit of profitability at the expense of more robust regulation not only cripples essential policies but also risks turning the industry into a laughingstock. Let’s not forget that without effective regulations, the once-promising vision of cryptocurrency as an egalitarian financial tool is at risk of being derailed.

5. A Diminished Reputation on the Global Stage

As the diplomatic ties weakened in light of domestic challenges, the U.S. stands in jeopardy of losing its position as a leader in fintech and digital innovation. Maintaining a strong reputation is crucial not just for attracting investments but also for inspiring confidence among the public and equity marketplace. If there’s one thing that history has shown us, it’s that countries whose political leaders engage in self-serving schemes ultimately pay the price—both economically and ethically.

While the U.S. has positioned itself as a champion of market innovation, the internal chaos created by these conflicts of interest could unravel decades of progress, exposing America to ridicule on a global scale. This not only affects the tech sector but could also erode consumers’ faith in the government’s ability to provide a safe and beneficial trading environment.

The stakes are high, and the need for ethical governance has never been more urgent. In a rapidly evolving digital age, the balance between personal ambition and public duty must be restored—before it is too late.