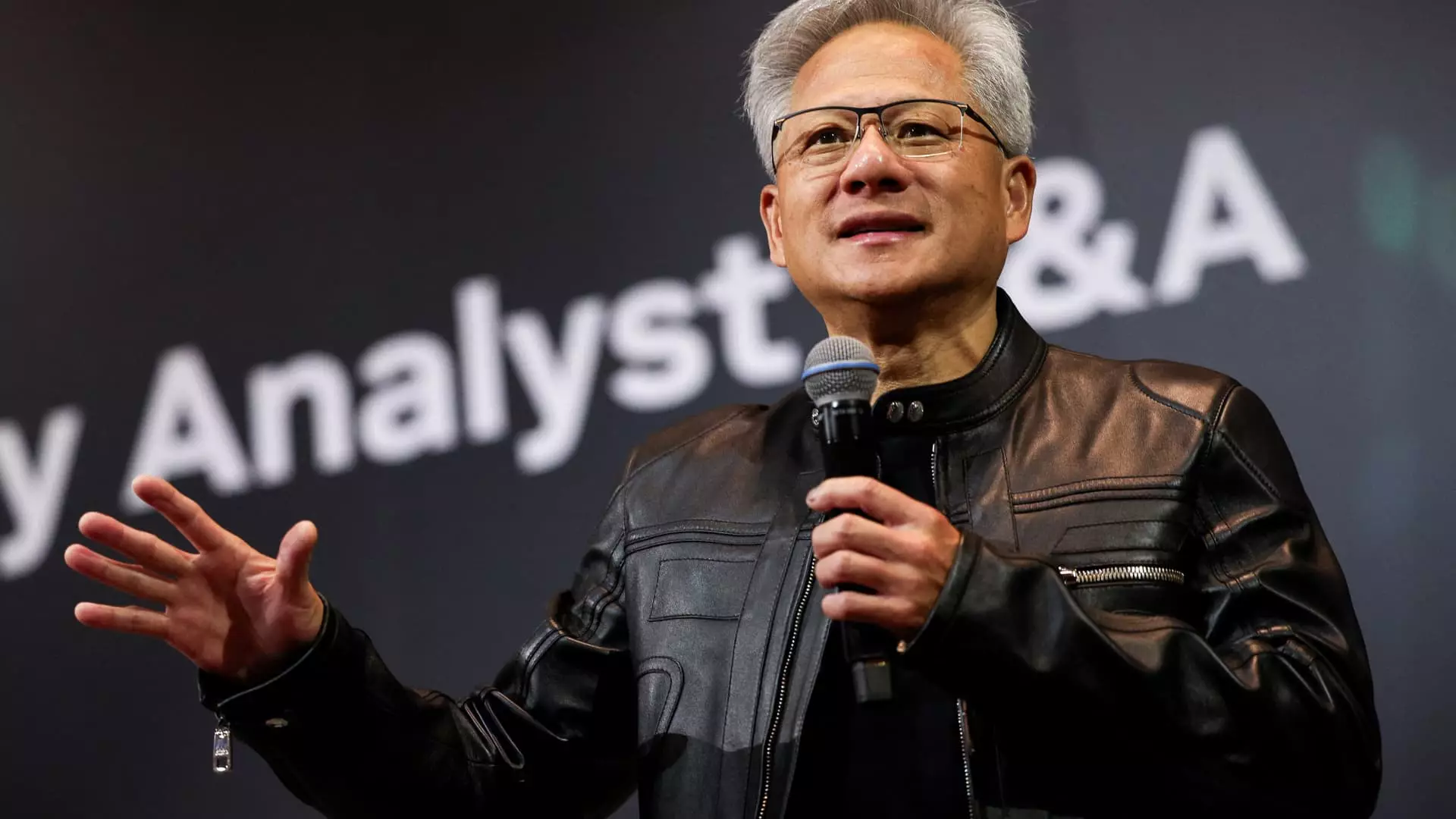

In a move that raises eyebrows across financial circles, Jensen Huang, CEO of Nvidia, recently sold a substantial portion of his shares—layered with ambiguity and ripe for scrutiny. With sales totaling approximately $50 million over a span of days, Huang’s decision to offload 300,000 shares seems more than a routine portfolio adjustment; it echoes deeper questions about confidence and the durability of Nvidia’s recent meteoric rise. Does this signal internal doubts about the company’s future prospects, or is it merely a calculated liquidity event?

Despite Nvidia’s market value soaring past $4 trillion—a feat that cements its dominance in AI and graphics processing—the company’s leadership appears to be making calculated moves that could camouflage underlying vulnerabilities. The fact that this sale aligns with a previously announced plan to unload up to 6 million shares suggests strategic financial planning rather than panic. However, in a volatile tech environment, heavy insider sales often cast shadows of uncertainty, especially when major shareholders and executives display hands-on involvement in their own stock sales.

The Broader Context: Political and Economic Undercurrents

Beyond internal corporate strategy, Huang’s stock sales come at a crucial geopolitical juncture. Nvidia’s push to resume sales of its H20 chips to China—despite previous restrictions—reflects a complex interplay of trade diplomacy and economic interests. The company’s hope to sell advanced chips in China indicates an awareness of the vast potential market, but also a recognition of risk. The U.S. government’s signals of approval for export licenses hint at a delicate balancing act: fostering innovation and business growth without provoking political blowback or restrictions.

This situation illustrates a pragmatic liberal approach toward globalization—acknowledging the importance of international markets while navigating national-security concerns. Huang’s comments in Beijing about plans to sell even more advanced chips underscore an optimistic, perhaps overly so, perspective on U.S.-China tech relations. For investors and policymakers alike, this could be a sign that Nvidia is betting heavily on continued cooperation, an assumption that might not withstand potential political shifts or economic constraints.

Market Sentiment and the Future Outlook

While the market cheered Nvidia’s financial performance, Huang’s selling activity serves as a stark reminder that even the most bullish narratives harbor caution. It’s easy to become captivated by sensational growth numbers and technological dominance, but insider sales sometimes reveal the cracks beneath the glossy surface. Strategic sales can be a way for insiders to diversify and secure their fortunes; however, frequent and large transactions may also reflect lingering doubts about sustainability.

Given Nvidia’s current trajectory, the question remains: how much of this success is built on genuine innovation versus market hype? And how much faith can investors place in a leadership that, despite exemplary success, is not above monetizing their stakes amid a boom? For a company so integral to AI’s future, their ability to adapt and temper exuberance with prudence will determine whether Nvidia’s rise is truly unstoppable or merely a temporary ascent in a hype-driven sector.

By critically observing these stock sales within the larger context, it’s clear that even in an era of unprecedented technological achievement, caution should remain the guiding principle. The illusion of unwavering confidence can be fleeting, and those who fail to recognize the signs of internal ambivalence risk being blindsided when market realities shift.