Advanced Micro Devices (AMD) appears to be riding a wave of optimism thanks to its impressive 32% revenue growth year-over-year, nearly touching $7.7 billion. Yet, beneath this seemingly bullish façade lies a complex web of vulnerabilities that threaten its future viability. Elevated revenue figures can often mislead investors into believing that AMD’s market dominance is unassailable. However, a closer and more critical analysis emphasizes that such growth is fragile, heavily reliant on geopolitical factors and high operational costs that could sap its momentum.

In the central narrative of AMD’s recent earnings, the company’s struggle to meet earnings expectations signals an underlying weakness in its core strategies. Missing the analyst consensus by a cent per share might seem minor, but it underscores the increasingly precarious nature of AMD’s financial health. It suggests that even amidst booming revenue, the profit margins are under pressure, likely impacted by rising R&D, licensing, and compliance costs, especially as U.S. export restrictions distort supply chains and sales targets.

More importantly, the semiconductor industry’s intricate geopolitical landscape acts as a double-edged sword. AMD’s dependence on international markets, particularly China, exposes it to the volatile arena of U.S.-China relations, which threaten to cripple growth prospects. The company’s efforts to navigate export controls and Chinese market restrictions make its future outlook profoundly uncertain. Efforts to develop AI chips that circumvent sanctions seem more ad hoc and opportunistic than a sustainable, strategic shift—highlighting a risky dependence on fluctuating political landscapes.

Strategic Overreach and Operational Burdens

AMD’s ambitions, particularly in the GPU and AI space, are ambitious but potentially overextended. The company reports a significant push in the datacenter segment, with a commendable 14% increase to $3.2 billion. Yet, Wall Street’s cautious tone reveals doubts about whether this growth can be sustained. Experts highlight that operating expenses are rising rapidly, impeding profit margins and limiting earnings leverage.

The increasing costs associated with supporting a broader software ecosystem and infrastructure for datacenter products threaten AMD’s profitability. It’s not enough to simply grow revenue; profit sustainability hinges on operational efficiencies—which AMD is struggling to achieve amid these heightened expenses. Furthermore, AMD’s efforts to diversify into AI and high-performance computing may be hampered as geopolitical restrictions and trade tensions inhibit market expansion.

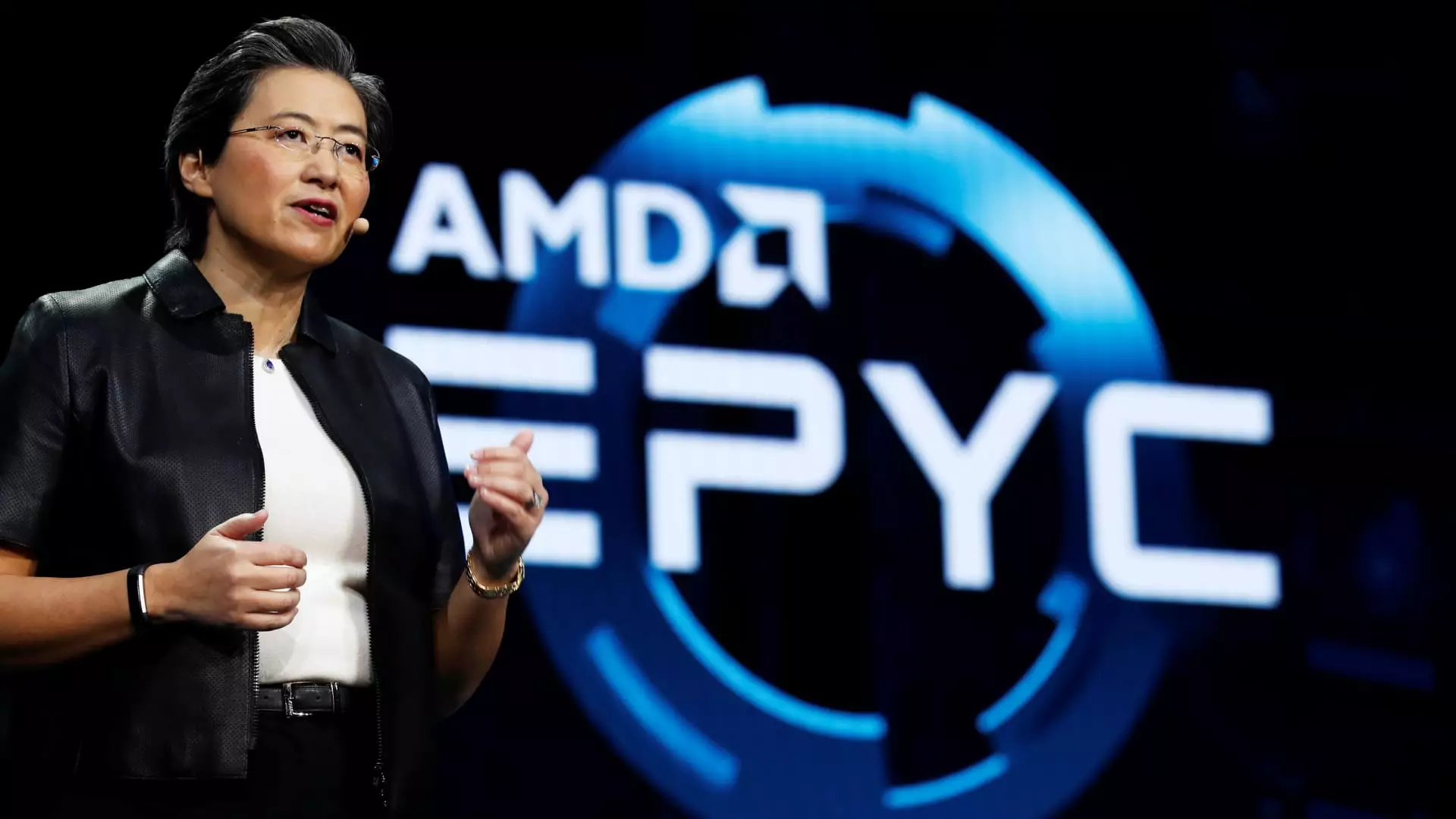

While CEO Lisa Su’s optimism about an impending “inflection point” in datacenter sales is noted, it smacks of wishful thinking rather than concrete evidence. Relying heavily on a few large customers for future growth is a risky proposition, especially given the unpredictable political climate and the potential for increased competition. AMD’s high valuation—despite solid revenue figures—may be built more on market hope than on a realistic assessment of sustainable growth.

Overvaluation and Overconfidence: A Cautionary Tale for Investors

What becomes clear from AMD’s latest earnings report is that much of its current value arguably stems from market sentiment rather than fundamental stability. The company’s valuation remains lofty, buoyed by future growth projections that look increasingly clouded. Investors must question whether AMD’s stock price truly reflects its underlying fundamentals or is driven primarily by hopes of a timely Chinese market reopening and the continued boom in AI applications.

The geopolitical uncertainties surrounding chip exports cast a long shadow over AMD’s prospects, especially as the Department of Commerce’s license review process remains unpredictable. The company’s acknowledgment that license approvals are delayed and the vague timeline for shipments to China suggest that AMD’s high growth trajectory could be derailed by factors outside its control. Such vulnerabilities raise red flags for the prudent investor who recognizes that market optimism should not eclipse risk management.

Furthermore, AMD’s attempt to portray its portfolio as “extremely strong” sounds more like a defensive maneuver than a testament to genuine market leadership. In truth, a significant share of AMD’s future hinges on government policies and geopolitical shifts that are inherently outside its control. This overreliance on external factors for growth should induce skepticism rather than blind faith.

In sum, while AMD’s technological innovation continues to impress, its macroeconomic and geopolitical dependencies present formidable risks that could undermine its long-term viability. For investors carefully balancing risk and reward, the current AMD story is a cautionary tale of hype, overconfidence, and the peril of overlooking deep structural vulnerabilities in pursuit of short-term gains.