In the realm of modern infrastructure, few companies occupy a position of such strategic importance as Equinix. With a sprawling network of 270 data centers across the globe, the company’s role in enabling digital transformation is undeniable. Yet, despite its powerful foundation, Equinix faces a wave of skepticism fueled by short-term volatility and market misinterpretations. This skepticism, which manifests in sharp share price declines following cautious capital expenditure disclosures, risks obscuring the company’s true potential. Far from being a sign of weakness, these signals point toward a robust, long-term growth story—one that savvy investors with industry insight recognize and can help shape.

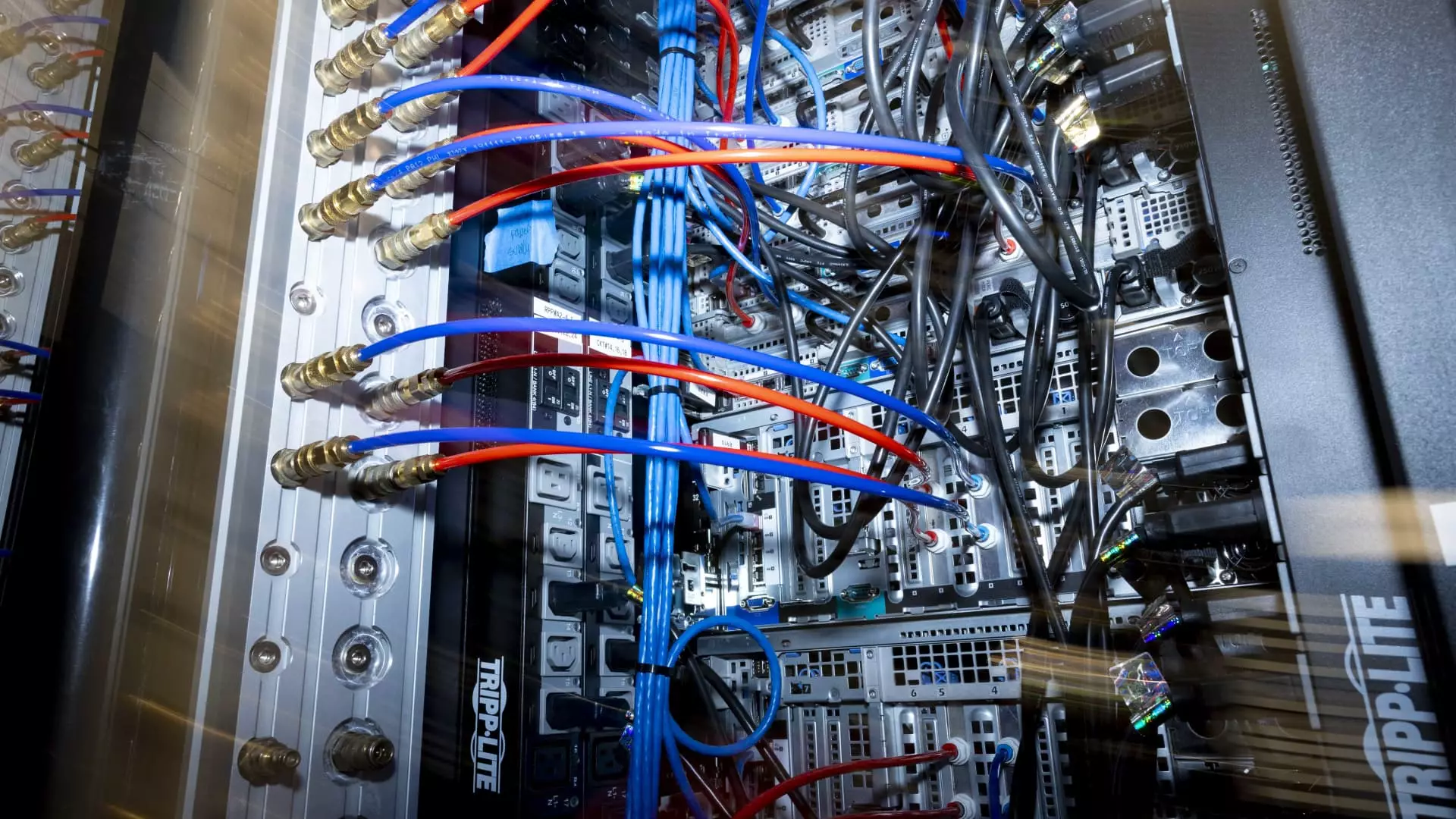

Equinix’s value transcends traditional real estate: it operates an interconnected ecosystem that has become critical for cloud providers, enterprises, and hyperscalers alike. Its geographical positioning in key markets places it at the nexus of data flow—making its assets increasingly indispensable as data consumption continues to surge. This strategic positioning ensures a durable competitive advantage, especially considering the growing costs and complexities associated with internal data center deployment. Companies are no longer building their own facilities; they are partnering with trusted providers like Equinix that can offer scalability and resilience at a fraction of the cost.

However, recent market reactions highlight a common myopia. The company’s disclosure of increased capital expenditures—anticipated to reach upwards of $4 billion annually by 2026—was met with alarm, provoking a nearly 18% share price plunge over a few days. To the uninformed or short-term focused investor, this looks like a risky overextension. But for those who grasp the industry’s dynamics, it signals an optimistic future. The heavy capex is an investment in capacity expansion aligned with rising demand from AI, cloud growth, and data-intensive applications. It’s a calculated bet that, in a few years, these investments will pay off handsomely, boosting Equinix’s revenue streams and margins.

Why Long-Term Vision and Industry Expertise Matter More Than Short-Term Fluctuations

The recent dip in Equinix’s valuation also sheds light on an often-overlooked advantage: the involvement of seasoned industry players like Elliott Management. Known for their astute activism and deep sector knowledge, Elliott’s increased stake signals confidence in the company’s strategic trajectory. Elliott’s track record goes beyond mere financial engineering; its experience as an owner and operator of data center businesses adds credibility and insight, giving it a nuanced perspective that most investors lack.

Elliott’s prior engagement with data centers—most notably through the acquisition and management of Ark Data Centers and its successful campaign at Switch—demonstrates their understanding of what makes these assets valuable. Their approach aligns with a focus on operational efficiency, strategic positioning, and long-term value creation. By advocating for better communication around Equinix’s growth plans and leveraging industry expertise, Elliott can help dispel short-term worries and foster investor confidence.

Furthermore, Equinix’s positioning in the AI space shouldn’t be underestimated. While it does not host AI model training directly, the company’s network infrastructure is ideal for deploying AI inference services—the phase where AI models are utilized in real-world applications. As AI adoption accelerates, the need for interconnected, high-performance data centers will become more pronounced, transforming Equinix from a mere colocation provider into a vital hub for AI services. Recognizing this shift, intelligent investors understand that the current capital expenditures are an investment into future dominance—not cautionary overreach.

Another layer of potential lies in operational efficiencies. Equinix has ambitious margin improvement targets, but industry benchmarking suggests room for surpassing these goals. Minor financial engineering—such as refinancing debt at lower interest rates—could unlock additional margin expansion, enhancing AFFO growth and delivering greater shareholder value. It’s a strategic balancing act, one that a focused activist like Elliott could accelerate through governance enhancements and strategic oversight.

The Unseen Opportunity in Market Misjudgment

Market misjudgments often stem from the failure to appreciate the full spectrum of a company’s strategic imperatives. Equinix’s current share price and valuation metrics may look, superficially, like overextensions or signs of impending trouble. Yet, beneath the surface lies a company poised for accelerated growth driven by structural shifts in technology infrastructure. The investments announced are not reckless—they are foundational, designed to position Equinix at the forefront of the global data economy.

The key for investors who truly understand this landscape is recognizing that short-term volatility is an essential piece of a much larger puzzle. Being overly reactive to quarterly reports or initial reactions to capex can blind investors to the long-term gains lying just over the horizon. Companies like Equinix that operate at the intersection of digital transformation and infrastructure are inherently cyclical—yet fundamentally resilient.

As institutional and dedicated investors begin to see the value in these strategic investments, the market will likely recalibrate. Equinix’s premium multiple, historically locked in due to its strong market position and growth prospects, can reassert itself once clarity is restored. The potential for activist involvement, especially from a firm with industry-specific expertise like Elliott, could serve as an external catalyst to align market perceptions with the company’s true value.

Ultimately, Equinix’s future hinges on recognizing this broader narrative—a story of infrastructure becoming the backbone of tomorrow’s digital economy. Market fears about cash flow and near-term growth should not overshadow the company’s capacity to capitalize on the impending waves of AI, cloud migration, and hyperscaler expansion. With intelligent oversight and strategic communication, Equinix could transform short-term skepticism into sustained long-term leadership.