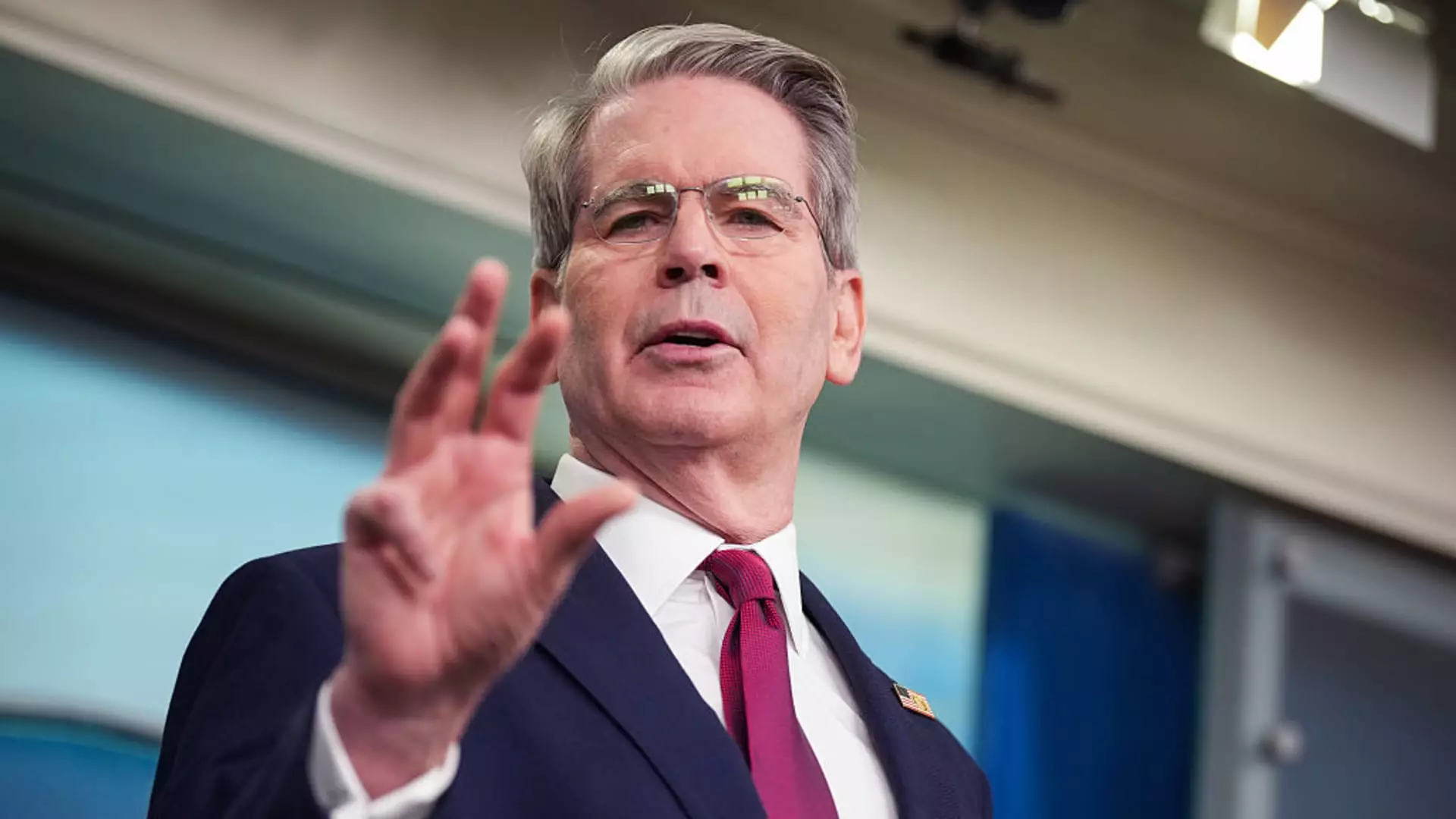

In an era defined by fluctuating markets and unexpected economic challenges, the faith of individual investors in the policies set forth by President Donald Trump is not just noteworthy—it’s remarkable. Treasury Secretary Scott Bessent recently highlighted that amidst turmoil, 97% of Americans have refrained from trading, choosing instead to steadfastly maintain their investments. This reveals something deeper about everyday investors: they seem to trust the long-term strategies over the panic typically exhibited by institutional traders.

When it comes to the stock market, emotions often dictate actions. While institutional investors often react hastily to unfavorable market conditions, everyday individuals appear to possess a more resilient outlook. The statistics from Vanguard suggest an unshakeable confidence among retail investors, which could speak to a fundamental belief in Trump’s economic policies, regardless of the chaos unleashed by tariff implementations.

Market Reactions: A Tale of Two Investors

The contrasting responses between institutional and retail investors during recent market fluctuations underscore a critical division in investment philosophies. While hedge funds and professional traders have scrambled for safety as tariffs threaten to steer the economy into recession, everyday investors have swooped in, capitalizing on lower stock prices. This divergence begs an important question: what does this say about the outlook for the economy moving forward?

As an experienced hedge fund CEO, Bessent has witnessed market dynamics from multiple vantage points. The cascading effects of tariffs, especially the highest we’ve seen in generations, have wreaked havoc on market stability, causing a temporary bear market that rattled even seasoned investors. However, amid this uncertainty, retail investors demonstrated a willingness to engage, perhaps driven by a belief that these price dips could yield substantial long-term gains. This action signals that many individuals are undeterred by short-term volatility, opting instead to trust their instinct rather than succumb to the panic prevalent in institutional circles.

The Evolving Landscape of Economic Perception

Yet, the fears expressed by institutional traders cannot be wholly discounted. With warnings surfacing about anticipated shortages and economic slowdown, even optimistic retail investors must grapple with the potential fallout from tariff-related disruptions. Torsten Slok, chief economist at Apollo, has indicated that consumers might soon experience tangible shortages, which could alter the reality on the ground.

Furthermore, Ken Griffin’s concern about the tarnishing of America’s global reputation due to trade conflicts raises important considerations about the long-term implications of the current administration’s policies. While retail investors may trust in the current trajectory, the potential threats to consumer confidence and economic growth could ultimately reverse any short-term optimism.

In this highly polarized investment landscape, the divergent narratives of retail versus institutional investors reflect broader societal beliefs about governance and economic policy. As the U.S. grapples with the ramifications of its tariff policies, the stakes have never been higher, demanding both vigilance and introspection from all stakeholders involved. Retail investors may currently hold the psychological advantage, but the coming months will test their convictions amidst pressures that could reshape economic realities.