As global investors grapple with the implications of tariffs on international trade, particularly concerning the United States and China, one sector appears poised to defy the odds: China’s technology industry. Despite recent fluctuations and concerns surrounding U.S. tariffs, analysts remain optimistic about the enduring potential of homegrown generative artificial intelligence (AI) and the broader tech ecosystem in China. The question then arises: how can we reconcile the volatility of international trade relations with the underlying strength of Chinese tech companies?

Distinguishing Reaction versus Reality

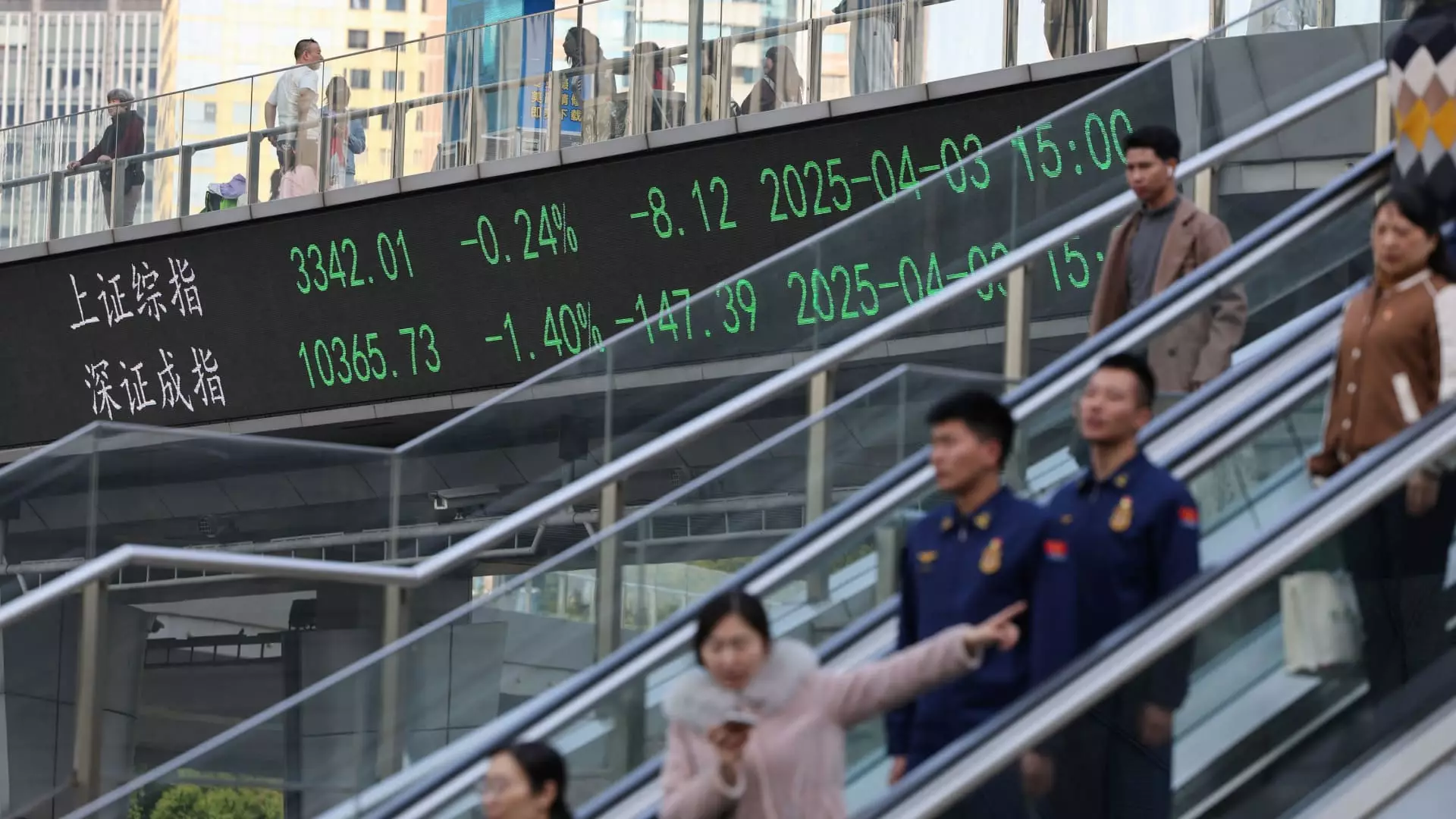

News of tariffs often leads to knee-jerk reactions among traders. For instance, Chinese stocks took a sharp dip at the start of the trading week as the announcement of new tariffs broke. However, closing numbers revealed a market that stabilized significantly, contrary to initial fears. The recent market response indicates a clear disconnect between market sentiment and fundamental company health. As noted by several analysts, many notable tech companies and consumer brands exhibit minimal exposure to the U.S. market. This insight sheds light on the resilience of these firms—they are not entirely reliant on developments across the Pacific. Fears driven by political narratives may inflate market volatility, but that doesn’t change the fundamental strengths of these companies.

The Value Proposition of Chinese Tech Stocks

Investments in technology tend to reflect future growth potential, and the current valuation of Chinese tech stocks presents an appealing argument for investors. Reports suggest that the average price-to-earnings ratio of key Chinese tech companies trails significantly behind that of American industry giants, often referred to as the “Magnificent Seven.” For instance, with valuations up to 52% lower than U.S. counterparts, the Chinese sector remains attractive for those looking to enter the market at a relatively low cost. It’s a compelling case for those seeking to capitalize on a latent growth curve in an essential industry.

Citi’s analysts, who are notably bullish on China’s tech sector, prefer domestic plays and have pinpointed opportunities in well-established companies such as Tencent and BYD. With growth and innovation at their core, these businesses are well-positioned to continue thriving, especially as they pivot towards services rather than traditional goods. This shift not only adapts to evolving consumer needs but also aligns itself with national policy trends aimed at bolstering domestic consumption and technological advancement.

Global Perspectives on Emerging Market Investment

Global market sentiment has been shifting; recent data indicates that nearly a quarter of international investors have become increasingly optimistic about the potential within China’s tech sector. This growing positivity is a testament to a broader reevaluation of investment strategies in emerging markets—China, in particular, has captured the attention of global equity funds that are now allocating significantly more resources in the region than over the past year.

This stark change arises not only from AI developments, such as Chinese startup DeepSeek’s claims of outperforming established players like OpenAI but also from a rapidly evolving consumer market. Companies are embracing AI to streamline operations, essentially enabling them to cut costs while also yielding greater outputs. With the looming uncertainties of tariffs, one might argue that these market dynamics underscore a pivotal moment for foreign investors willing to stake their claim on the transformative power of technology in the Chinese market.

The Safe Harbor of Healthcare: A Case Study

Among the sectors less affected by U.S. tariffs is healthcare, a domain where Chinese companies are demonstrating resilience and innovation. Pharmaceuticals were notably excluded from recent tariffs, allowing companies like Wuxi Biologics to operate with reduced regulatory constraints. The need for affordable healthcare solutions has bipartisan support in the U.S., which offers a unique positioning for Chinese biotechs.

As Jefferies analysts have illuminated, even the prospect of future tariffs seems unlikely to tilt the scale against Chinese biopharmaceuticals, considering their collaborations with U.S. firms and their capacity to offer streamlined cost structures that benefit both parties. The convergence of shared interests in healthcare could yield mutually beneficial relationships, despite the antagonism manifest in other sectors.

A Broader Economic Context

While analysts express optimism about the tech industry’s prospects amid tariff disputes, it is essential to remain cognizant of the lurking economic ramifications on China’s overall GDP. As many firms pivot towards innovative tech practices, the indirect effects of strained international relations remain a pertinent topic. Morningstar’s warning of potential market volatility is a prudent reminder: while the tech sector might be on a growth trajectory, economic interdependence means that unforeseen tariffs can have ripple effects affecting broader economic performance.

In a world characterized by complexity and uncertainty, the willingness of investors to support China’s tech sector amidst tariff trepidations may be a testament to innovation’s enduring promise and the ever-resilient backbone of emerging markets. As global landscapes shift, those not afraid to explore these opportunities may find themselves well-positioned to leverage the potential of one of the world’s most dynamic sectors.