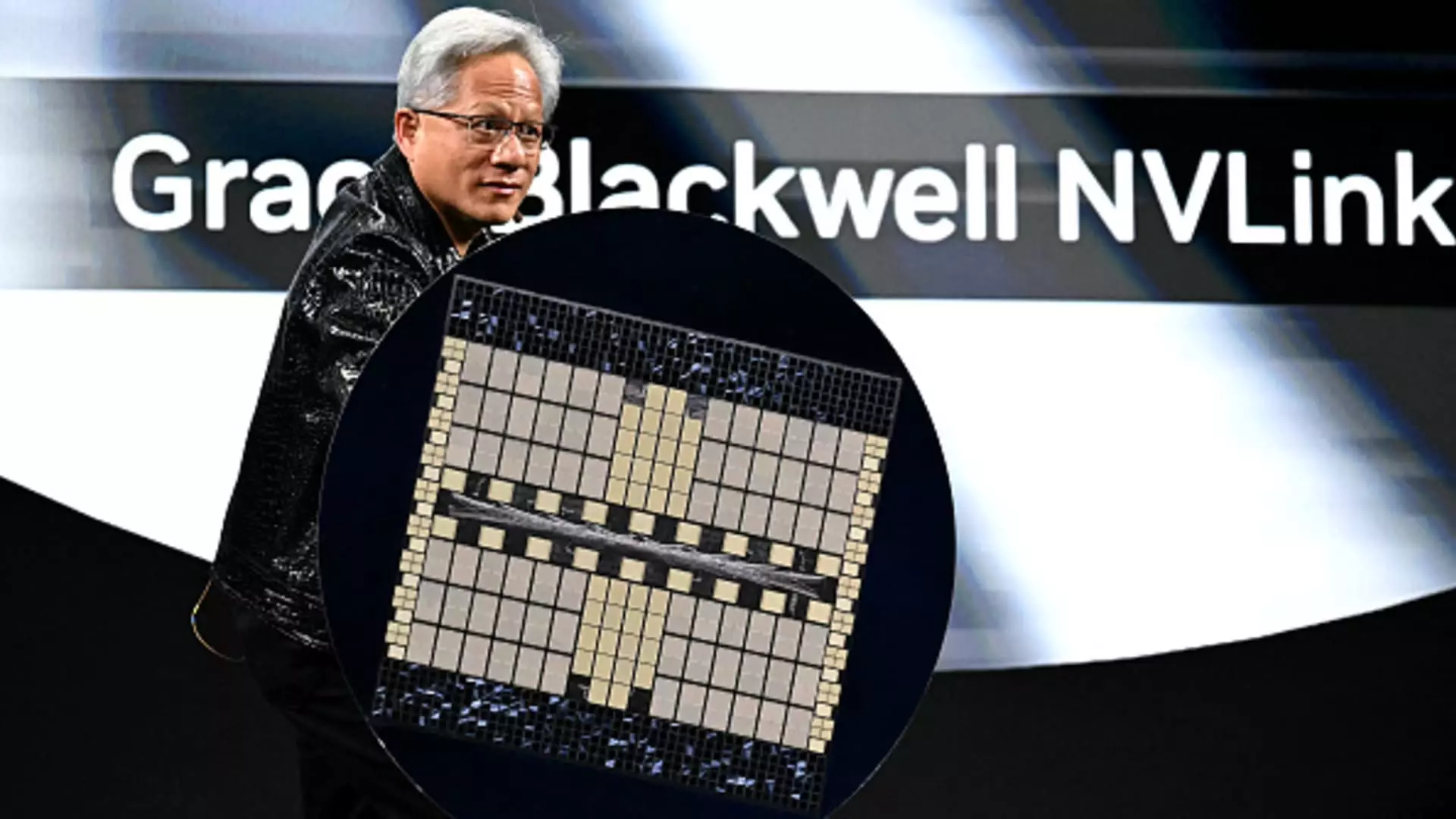

In the ever-volatile world of stock trading, Nvidia has become a symbol of resilience amidst the market’s chaotic seas. After taking a hit earlier in the year, with shares plummeting nearly 14% since 2025 began, the stock surged over 6% today, a remarkable turnaround. It’s not merely the figures that impress; it’s indicative of a larger trend where determination meets strategy in the tech sector. Nvidia’s elite status not only within the chip manufacturing industry but also as a cornerstone of innovation highlights a crucial lesson: businesses that pivot and adapt can effectively thrive in the face of adversity. The fact that such a steep drop can lead to a rebound suggests that investors remain fiercely bullish on tech, reinforcing the belief that the digital economy’s foundations are solid—even as the uncertain environment of tariffs and regulations looms.

Target’s Gravity: An Eroding Consumer Confidence

Contrarily, the retail segment seems to be tumbling. Target’s stock slipped about 3%, and fellow retail giant Walmart followed suit with a nearly 2% decline. This dual downturn raises eyebrows and questions about consumer sentiment. When retailers like Target struggle, it reflects a broader unease among consumers, suggesting that discretionary spending is tightening as inflation and economic pressures take hold. The phenomenon where consumer defensive stocks waver indicates an unsettling truth: as people’s purchasing power diminishes, so does their confidence in the economy’s stability. It’s an alarming warning for those in power, a hint that complacency in economic policy could spell doom for America’s retail bastions.

Crocs: The Unexpected Phoenix Rising

On an upswing, we have Crocs—yes, Crocs—surging by 3% following an upgrade from Loop Capital. The once-mock-fashion icon has redefined its market relevance, turning the heads of not only consumers but investors, through clever branding and a strategic approach to product development. This reflects a significant truth within the realm of capitalism: undervalued assets, when placed in the right strategic context, can gain traction and thrive. The market’s ability to reward such unpredictability offers a clear lesson; success often lies in viewing potential where others see ridicule.

Sunrun: The Bright but Flickering Future of Solar Energy

Conversely, Sunrun’s precipitous decline of about 7% reveals a more sobering narrative about the sustainability sector. Analyst caution from Jefferies comes amid a lackluster recovery in solar energy, casting shadows over the optimism bred by previous initiatives like the Inflation Reduction Act. This suggests a pressing need for visionary leadership within the sector that can navigate regulatory challenges and foster innovation—transforming how energy solutions align with market demands. The rollercoaster of the renewable energy landscape demonstrates a critical point: enthusiasm alone does not equate to success; sustainable practices must be married to profitable business models.

Groupon’s Phoenix Transformation: A Market Surprise

In stark contrast to the discouraging narratives above, Groupon’s stock exploded over 39% following a more optimistic revenue forecast. This remarkable shift not only showcases the potential for rebound but also emphasizes an essential truth: adaptability in strategy and business model can spur growth, even in seemingly stagnant markets. The company’s outlook to exceed Wall Street’s expectations represents not only an impressive recovery narrative but also reflects broader economic cycles. Investors should take heed; markets can surprise when foundational strategies pivot toward consumer needs and market realities instead of merely sticking to historical models.

The Avalanche of Downgrades: Caution in Corporate Growth

As Myriad Genetics hiked by 7% with an upgrade, we also saw giants like PepsiCo downshift after warnings of limited growth prospects. The juxtaposition here is telling; for every optimistic story, there’s a cautionary tale. It paints a detailed picture of the complex dynamics at play in today’s market. Investments require boostful foresight and a willingness to innovate, yet without it, even the biggest brands can’t avert a fall. A shift in corporate culture must accompany such growth, emphasizing a balance between innovation and core offerings—valuable lessons for aspiring companies that toe the line.

Capital markets are undeniably unpredictable, yet the stories within them highlight the delicate dance of resilience and vulnerability that defines American capitalism. The interplay between these forces shapes the stock exchange’s fabric, offering cautionary tales and inspiring moments alike.