Contemporary Amperex Technology (CATL), a titan in the battery manufacturing sector, is increasingly positioning itself beyond mere hardware supply. While traditional industry players have often focused solely on delivering robust battery packs, CATL’s strategic vision aims for something far more ambitious: the creation of an integrated software ecosystem powered by artificial intelligence. This pivot reflects a broader trend in the technological landscape, where control over data, software, and service platforms can translate into sustained market dominance. Yet, this evolution also raises concerns about the monopolization of the entire ecosystem, which could stifle competition, innovation, and even threaten the very principles of open markets.

The company’s AI-powered tools that monitor batteries in real-time, issuing early safety warnings, exemplify a shift from simple manufacturing to advanced, value-added services. Such capabilities not only improve product safety and reliability but also establish a feedback loop of data that feeds into further innovation and operational efficiencies. By embedding themselves into the lifecycle of the battery, CATL can collect vast amounts of data, allowing them to refine their products continuously and deepen their influence over supply chains and associated industries. This monopolistic potential, if unchecked, could grant CATL unprecedented control over the future of electric vehicle (EV) batteries, sidelining competitors and possibly even marginalizing consumers and smaller players in the process.

Financial Fortitude and Strategic Expansion

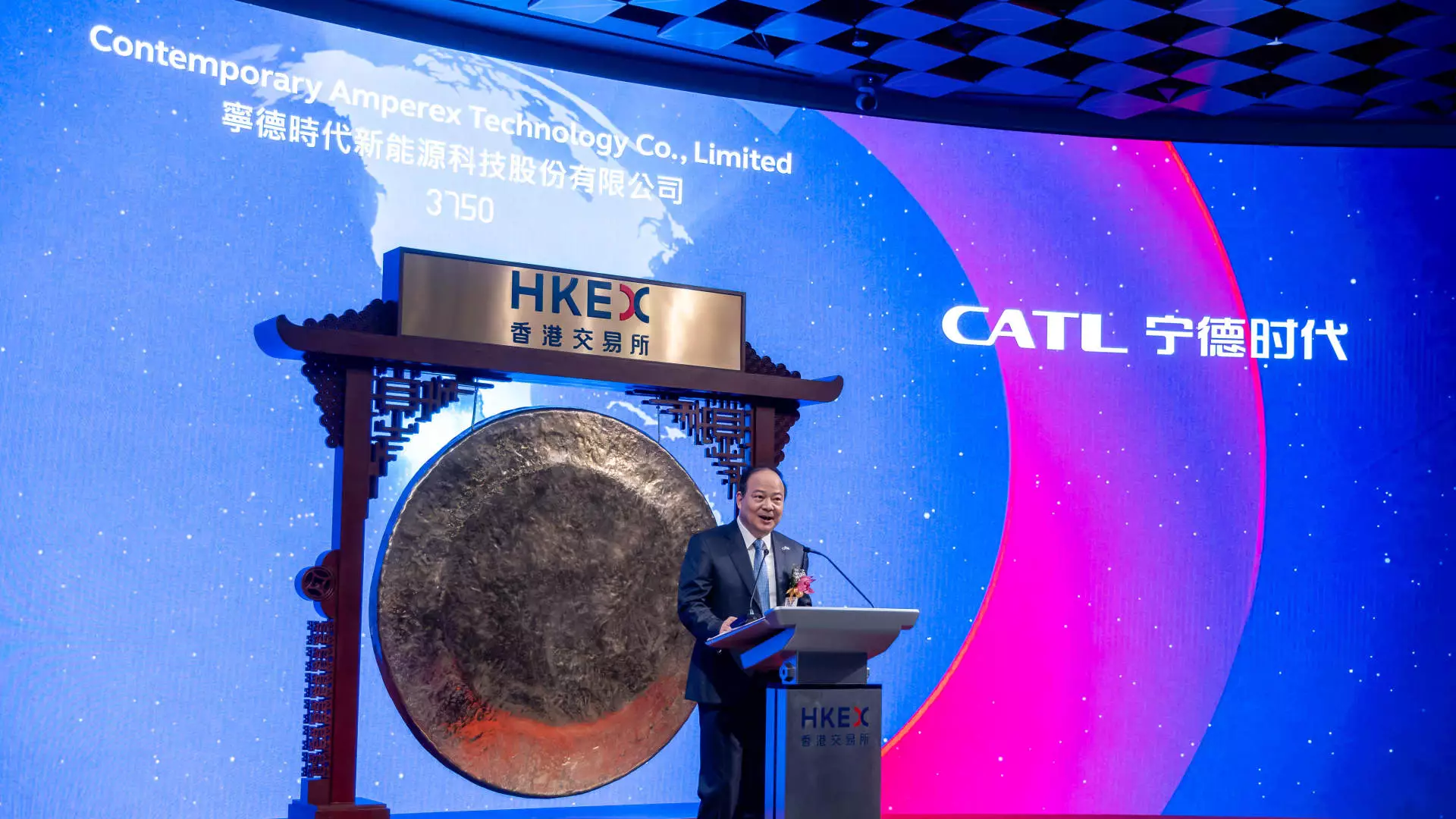

Recent analyst reports reflect the growing confidence in CATL’s prospects. Morgan Stanley, for example, has significantly raised its price target on the company’s Hong Kong shares, signaling optimism about its valuation. The projected valuation surpasses current trading prices, indicating that markets expect CATL’s innovative ecosystem to unlock long-term value—beyond mere sales of batteries. Such expectations are reinforced by the company’s enhanced market share, technological superiority, and strategic expansions into Europe and Southeast Asia, notably Hungary and Indonesia.

Investments in Europe signal CATL’s intent to establish a more diversified and resilient global footprint, helping it circumvent geopolitical risks that have recently intensified. The US government’s designation of CATL as a “Chinese military” entity complicates these prospects, yet, paradoxically, may also bolster its domestic market position by strengthening nationalistic narratives or prompting Western companies to reconsider their supply chain dependencies. Despite these geopolitical hurdles, CATL’s push into licensing agreements—a strategy that could generate significant recurring revenues—demonstrates a sophisticated approach to monetizing their technological advancements. Although profitability may only materialize in the coming years, the groundwork being laid now solidifies CATL as a formidable force.

Geopolitical Risks and the Threat to Free Market Competition

The geopolitical landscape poses a double-edged sword for CATL’s ambitions. While the U.S. Department of Defense’s restrictions and political tensions underscore vulnerabilities, they also underscore the strategic importance of China’s battery giant. The designation as a military-linked entity, which CATL disputes, highlights the rising geopolitical risk that threatens to interrupt supply chains or limit access to key markets. Such risks are not trivial and carry the potential to distort the competitive landscape on a global scale.

Yet, the more insidious risk lies in the potential for market monopolization. With their vast technological ecosystem, expansive manufacturing footprint, and strategic licensing deals, CATL is well-positioned to dominate the battery industry, not just in terms of products but also in controlling the innovation pipeline and service infrastructure. This concentration of power can lead to a situation where smaller competitors are marginalized, and innovation stagnates because the ecosystem becomes too centralized.

Furthermore, CATL’s partnerships with automakers like Zeekr and Xiaomi signal a focus on capturing entire segments of the EV market. This vertical integration—a hallmark of monopolistic strategies—further consolidates their market influence. While such moves seem advantageous for consumers in the short term through technological advancements and better products, they risk creating a landscape where competition is limited, prices could rise, and innovation driven by rivalry becomes subdued.

A Market at a Crossroads: Innovation or Oligopoly?

In the grand scheme, CATL’s trajectory epitomizes the classic tension between innovation and monopolistic consolidation. Its technological leaps, strategic alliances, and expansion plans are undeniably impressive, yet they come with the responsibility—if not the obligation—to ensure that the market remains open and competitive. The current trend suggests a drift toward a high-tech oligopoly, where a handful of corporations control not only production but the standards, data, and software that underpin the industry.

Governments and regulators must scrutinize these developments critically. While the free market benefits from technological progress, unchecked dominance by a single entity or a small group of players can undercut the very spirit of innovation. For now, CATL’s influence is undeniable, and its expanding ecosystem threatens to redefine power dynamics in the global EV supply chain. Whether this evolution evolves into a sustainable, innovation-driven future or morphs into a monopolistic nightmare depends critically on regulatory oversight, competitive resilience, and strategic vigilance by the international community.

In a world where technological dominance increasingly translates into geopolitical power, CATL’s rise underscores the importance of maintaining a balanced approach—one that rewards innovation without allowing it to morph into an unchecked monopoly that could threaten the economic and strategic stability of the global market.