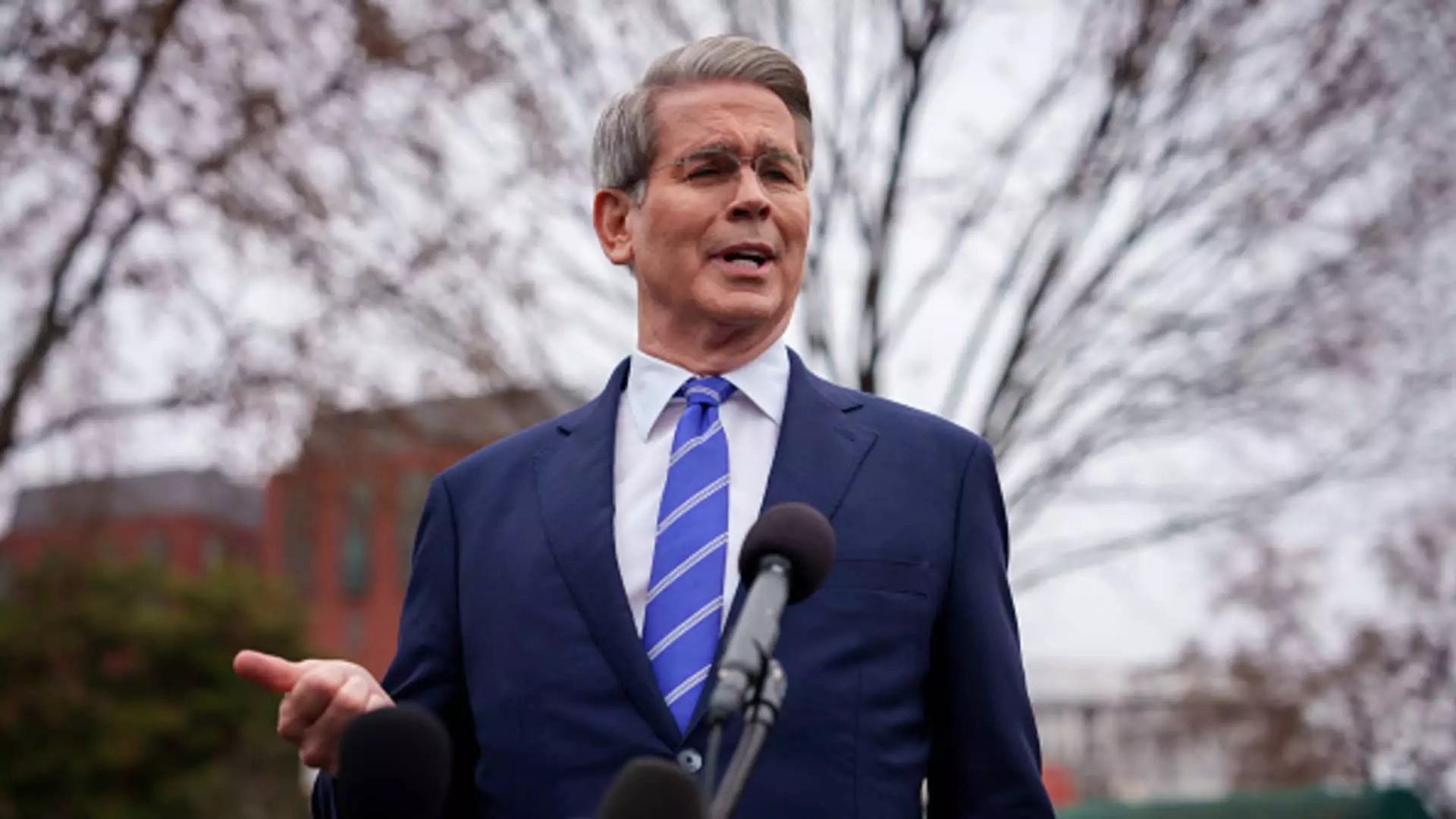

The recent sell-off in the stock market, particularly within the technology sector, can be attributed to significant shifts in investor sentiment and external competition rather than the economic policies imposed by the Trump administration. Treasury Secretary Scott Bessent made it clear: the downturn isn’t primarily a result of “MAGA” policies but rather a reaction to the emergence of highly competitive players like the Chinese AI startup DeepSeek. This shift poses a more nuanced issue that demands a thoughtful analysis rather than a knee-jerk reaction from investors.

DeepSeek’s Disruptionology

The introduction of DeepSeek’s groundbreaking AI models triggered a cascading effect on the so-called Magnificent 7 stocks—Apple, Amazon, Tesla, Alphabet, Microsoft, Meta, and Nvidia. These market titans had thrived on their AI investments, and the perceived threat from a competitor capable of offering similar services at lower costs unveiled vulnerabilities that investors were previously willing to overlook. The fallout is telling; the Nasdaq Composite plummeted by about 13% from its peak, providing both an opportunity and a cautionary tale about the volatility inherent in the tech sector.

The Tariff Quandary

With President Trump instigating steep tariffs as part of his “reciprocal tariff” policy, anxiety in the market intensified further. Critics argue that the sudden influx of these tariffs could lead to inflation and economic stagnation, spurring fears of a recession as investors reevaluate risk in the context of these new economic barriers. The S&P 500 briefly dipped into correction territory, marking a moment of reckoning for businesses heavily reliant on international trade and supply chains. However, the true impact of these tariffs might be less dire than many anticipate if they ultimately serve to fortify domestic industry rather than merely disrupt it.

Rethinking the Narrative

While it’s tempting to label the recent developments as a full-blown crisis, a closer look reveals that the market’s reaction may have been fundamentally disproportionate. There’s a prevailing belief that the structural integrity of the tech sector remains robust—even amidst external competition and policy shifts. Bessent’s stance suggests a belief in the resilience of the underlying economy. If policies reflect a focus on creating the best possible economic environment, long-term growth could conceivably outpace the short-term volatility investors are currently experiencing.

Investor Psyche and Market Fluctuations

Panic-driven sell-offs often overlook the strategically favorable position of many companies, allowing savvy investors to identify potential rebounds. Often, the severity of market responses is inversely related to actual economic performance; irrationality can drive prices down, creating buy opportunities for those willing to explore beyond the surface-level headlines. The irrationality of investor behavior highlights a critical aspect of market engagement: good judgment should prevail over fleeting emotions.

The combination of emerging competitors like DeepSeek and the long-term repercussions of heightened tariffs represents more than a momentary disruption in the technology space. Rather, they symbolize a call to adapt and innovate in a landscape that is continually evolving. Investors would be wise to engage critically, keeping a steadfast focus on the longer trends that define market health rather than succumbing to momentary anxieties and distractions.