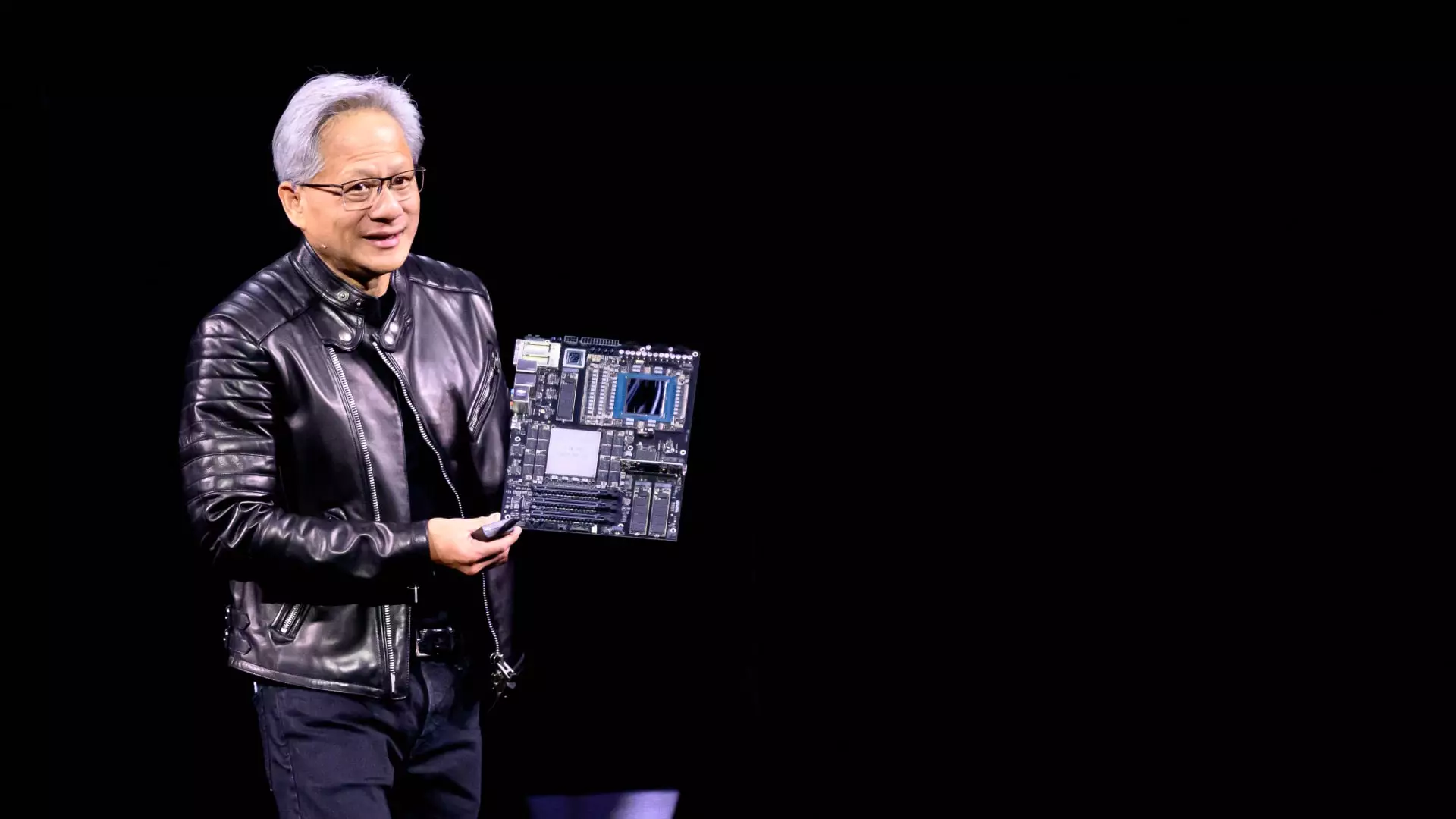

The technological landscape is constantly evolving, but Nvidia CEO Jensen Huang’s recent keynote at the GTC conference has pushed the boundaries of what we consider possible. His clear message was loud and unmistakable: Faster chips equal more significant returns. The shift in focus from the mere acquisition of hardware to the strategic utilization of speed marks a paradigm shift not only in AI technology but also in the operational frameworks of hyperscale companies. Huang’s assertion that “speed is the best cost-reduction system” indicates a blistering pace of innovation that prioritizes performance over traditional cost-related hesitations, introducing a framework where technological speed dictates market viability.

This isn’t just a tech announcement; it is a wake-up call for businesses. Companies must adapt rapidly or risk falling behind. Today, we live in an age where real-time data processing isn’t just a luxury—it’s a fundamental necessity. The call to arms resonates most clearly in industries that lean heavily on AI; adaptation is not optional, and that comes with a hefty price tag.

The New Economics of AI Infrastructure

Another critical takeaway from Huang’s keynote involves the intricate economics underlying the rapid rollout of Nvidia’s Blackwell Ultra systems, which purportedly promise a staggering 50 times more revenue than their predecessors, the Hopper systems. The mathematics Huang presented, which quantified the cost-per-token, offers both a fascinating revelation and a stark reminder of the high stakes involved in AI-driven cloud computing. The direct relationship he drew between cost, speed, and ROI encapsulates a future where decision-makers must weigh the potential long-term benefits against initial outlays in a market characterized by typical volatility.

Investors should take heed: the urgency expressed through Huang’s numbers suggests a transformative phase is upon us. Should the expectations set forth come to fruition, the AI landscape will undergo a tectonic shift, led by Nvidia’s guiIde. However, there’s an underlying tension when it comes to the capital expenditures of major cloud providers like Microsoft and Google. Their willingness to invest may ultimately determine the pace at which this new infrastructure rolls out.

The ASIC Dilemma and Custom Chips

In an industry ripe for disruption yet fraught with challenges, Huang’s dismissal of the potential threats posed by custom chips presented by cloud providers provides a dose of realism that is often overlooked. The obstacles faced by these ASICs—Application-Specific Integrated Circuits—are not just technical; they are fundamental to their flexibility and adaptability in a fast-evolving landscape. Huang’s insights underscore an important point: A chip’s commercial viability is intrinsically tied to its capability to remain competitive in a rapidly shifting market.

For the armchair tech pundit, there may be a glimmer of hope in the notion that custom chips could even the playing field. Huang, however, argues persuasively that the essence of Nvidia’s success is not merely hardware but the continual evolution of their systems to support agile AI development, thereby keeping them one step ahead. The hurdles faced in launching ASICs often exceed technical limitations; they often fail to scale to market demands and consumer behavior.

A Call to Action for Investors and Companies

Huang’s certainty that “hundreds of billions” of dollars will flow into AI infrastructure over the next few years is ominous yet exhilarating. This tangible surge in investment represents an unprecedented opportunity for companies and investors alike. As cloud customers finalize budgets and plan extensive data center infrastructures, the opportunity is ripe for those who align with Nvidia’s vision. Firm decisions must be made swiftly; fortunes will favor the bold as they rush to embrace innovations that satisfy the burgeoning demands of AI.

The messages conveyed by Huang during his keynote illuminate the critical role that speed will play in the upcoming technological revolution. The pathway toward advanced AI solutions is paved with significant expenditures, underpinned by a culture of innovation driven by speed and performance. Huang’s takeaway for the industry, therefore, presents not just a command but a clarion call: Embrace the shift, invest wisely, and prepare for a future where the value is defined by speed, not just chips. The stakes are high, and the rewards for early adopters could be monumental.