In Omaha, a remarkable phenomenon unfolded during Berkshire Hathaway’s annual meeting, where the intersection of wealth and goodwill took center stage. Witnessing shareholders frantically pursue memorabilia signed by the iconic Warren Buffett was both exhilarating and somewhat alarming. The unexpected checks arriving in mailboxes, wire transfers from distant shores, and the vast sums of money being offered at silent auctions showcased a unique blend of obsession and altruism. This event was catalyzed not just by the legendary CEO’s signature but also by his unwavering commitment to supporting the local community through charity, creating a dynamic that made philanthropy feel almost competitive.

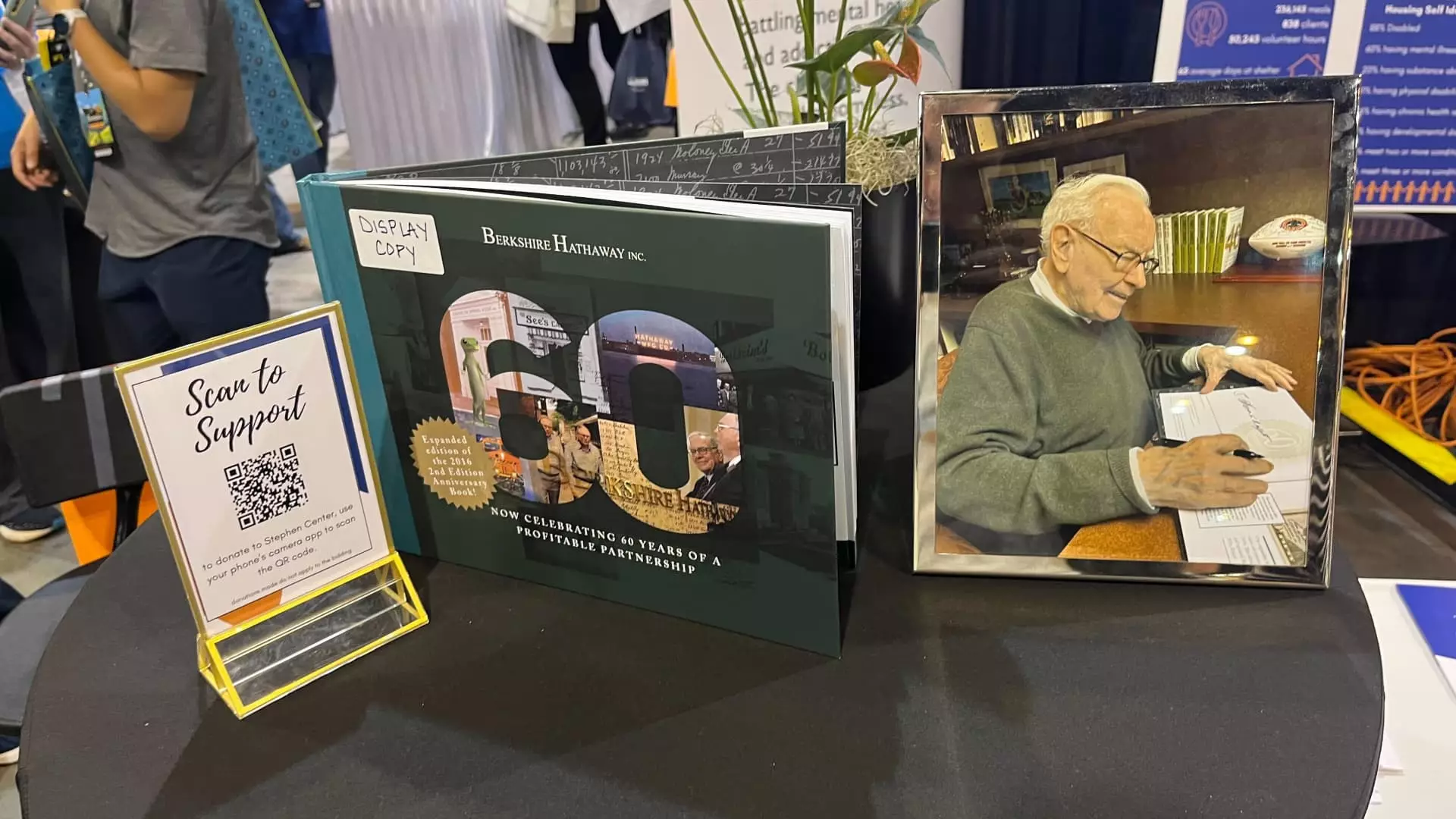

Buffett’s announcement of his retirement plans added a layer of urgency to the auction. Suddenly, the signed copies of the anniversary book “60 Years of Berkshire Hathaway” became not just collectibles but also meaningful artifacts that carry the weight of Buffett’s legacy. Ultimately, the event raised a staggering $1.3 million for the Stephen Center, an Omaha nonprofit that provides shelter and addiction recovery services. This was not just a monetary contribution; it was a resounding endorsement of local philanthropy in a world that often seems too consumed by wealth accumulation.

Repercussions for Local Communities

As the bids climbed, so did the visibility of the Stephen Center’s mission. The organization had previously operated under the radar, but Buffett’s involvement catapulted it into the spotlight. This is not just about raising money; it is a paradigm shift in how we perceive corporate responsibility. The surprising spike in donations, with $45,000 collected outside of the auction itself, grounded Buffett’s philanthropic drive in a community-centric ethos. The donors, some of whom expressed immeasurable gratitude for Buffett’s impact on their lives, highlighted an essential truth: wealth can—and should—be utilized as a vehicle for societal improvement.

Buffett’s pledge to match every dollar raised from the auction creates a multiplier effect that amplifies the impact of every individual contribution. It brings to light an ethical obligation for the wealthy: that they should not only invent and invest but also give back. The importance of community involvement, especially in times of increasing socioeconomic disparity, cannot be overstated. People in positions of financial power should use that power judiciously, addressing the needs around them rather than solely focusing on personal gain.

Changing the Narrative on Wealth and Generosity

Interestingly, the actions surrounding the auction debunk the narrative that philanthropic endeavors are only for the wealthy elite. Matthew Rodriguez, a real estate professional and one of the winning bidders, articulated a sentiment that many shareholders probably felt: participating in the auction was an opportunity to get a slice of Buffett’s legacy while supporting an incredibly deserving cause. His winning bid of $50,000 was both a heartfelt personal investment and a calculated move in the world of high-stakes philanthropy—a true testament to today’s evolving relationship with wealth.

The emotional connection to the Stephen Center emerged as personal stories unfolded. Many who bid or donated offered their funds in honor of their experiences, reinforcing that philanthropy often operates at the intersection of personal history and community needs. This notion shifts the public perception of philanthropy from mere charity to a communal responsibility, wherein every wealthy individual has a role.

Buffett’s Legacy as a Blueprint for Future Generations

Warren Buffett’s decisions around wealth distribution exemplify a profound belief in the need to dismantle wealth dynasties. His insistence on donating 99% of his fortune to charity reflects a significant shift in how affluent individuals ought to view their legacies. Leaving colossal inheritances can perpetuate unearned advantages, while philanthropic commitments increase societal contributions. This perspective is crucial for future generations, promoting a culture of giving that rivals the society’s passion for accumulating wealth.

The importance of such thinking extends beyond the individual. It becomes a societal challenge that necessitates fresh dialogues around the responsibilities of the wealthy. If Buffett and his contemporaries can forge pathways that shape philanthropic standards, then there is hope that the future will be marked by a greater sense of communal ownership and responsibility.

In the world of capitalism, where financial dominance often overshadows ethical considerations, events like Berkshire Hathaway’s annual meeting serve as a reminder that corporate giants can become conduits for collective well-being. Buffett has demonstrated that altruism and entrepreneurship can coexist, setting forth a powerful legacy that may soon resonate with generations to come.